For Financial Literacy Resources, NFEC Options are Second to None

From small workshops to full-scale events, the NFEC offers the most all-inclusive Financial Literacy Resources available to support a financial education initiative of any size. These materials – including some free financial literacy resources – include curriculum packages for all age groups; fully-developed materials for marketing and promoting a program; practical learning activities; information about how to host and design an event; and training in program delivery.

In addition to their comprehensive scope, the NFEC’s Financial Literacy Resources were developed to line up with findings of the latest cutting-edge research in education, financial education, changes to the financial landscape, and innovations in personal finance management.

Educational Methodologies of NFEC Financial Literacy Resources are Evidence-based

Recent advancements in educational research have clarified that learners vary widely, in both learning style and motivation levels. Specific to personal finance education, people also bring a broad variety of content knowledge and pre-existing financial habits to the table. Each person has a different emotional connection with money and current financial reality. For those reasons, the NFEC has developed its Financial Literacy Resources to be grounded in solid research principles and adaptable to support the full diversity of learners’ knowledge bases and preferred styles of instruction.

To help students become invested in their own learning process, the NFEC develops free financial literacy resources that apply metacognition, personal reason development, and self-regulated learning. For example, offering students choices in terms of learning focus or how they complete activities – plus opportunities to reflect on what they already know, versus what they still need to learn – both increases engagement and guides instructional monitoring.

Vary Program Touchpoints to Maximize Impact of Financial Literacy Resources

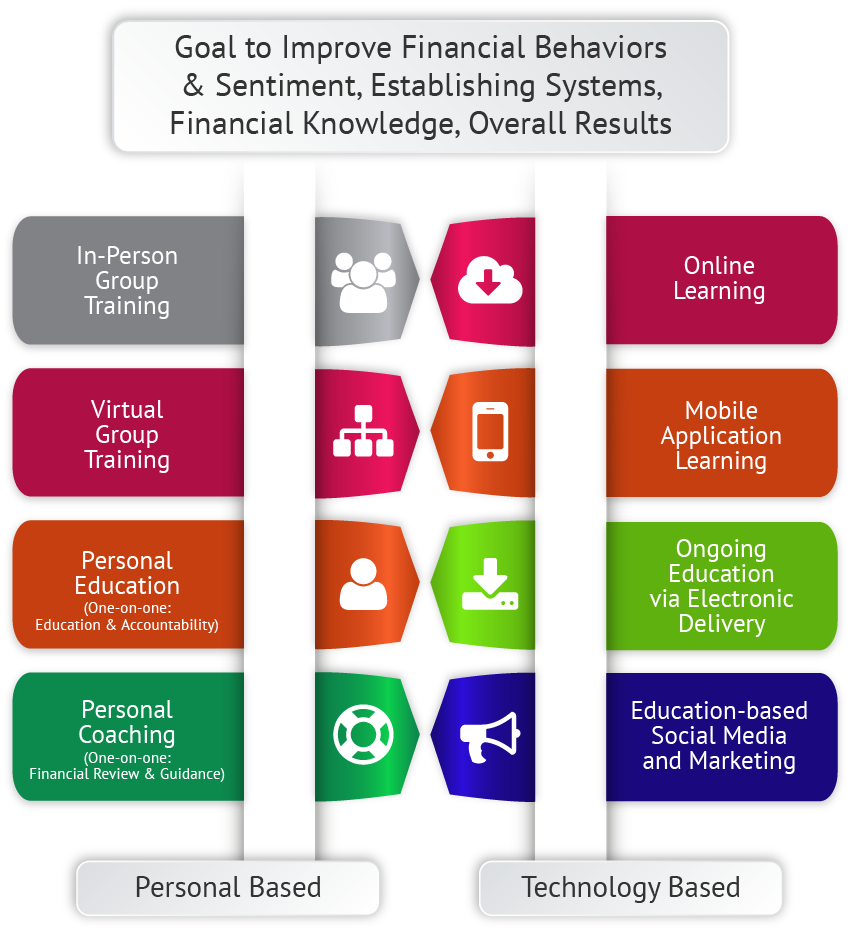

In developing its personal finance resources package, the NFEC recommends that you include multiple touchpoints in education planning to increase learners’ knowledge retention, provide learning at opportune times in participants’ lives, and remind them of key points they can apply in their daily lives. Well-planned programs have educational components that work together toward a common goal. The NFEC programs’ primary goals are to help learners change their financial behaviors and sentiments in a positive direction; establish systems that support personal finance management; and increase their financial knowledge. Thus you can achieve promising results for the overall program.

In addition, NFEC financial literacy resources apply multimethod delivery modes that combine three primary educational approaches: in-person, technology-based, and continuing education.

Featured by The Federal Reserve

According to the Federal Reserve, the NFEC’s multimethod delivery options represent best practices for financial education at the college level.